|

Lobbyist suggests liquor stores could be next if public schools get tax exemption!

(Not an April fools joke)

Yesterday a lobbyist for the New Hampshire Municipal Association (formerly the LGC) testified for a second time against HB662, a bill that would provide property tax relief to public charter schools and redirect the money to teachers and students. During testimony a lobbyist representing NHMA suggested that if the state were to exempt these public schools from property taxes, that liquor stores in strip malls could be next. ( click here for video) Students in the audience appeared distressed at what they had heard. This is the same group/lobbyist that had previously suggested ( audio file here), that instead of requiring their clients to refund property taxes to these public schools that charter schools should take money from a program designed for poor people. During the hearing, school Director Jennifer Cava testified that her school is forced to pay twice as much in property taxes as it can budget for student textbooks!

After the hearing I spoke with a group of students. It was clear that they were disappointed in the process and some of the legislators. Students expressed appreciation however to Senator Kevin Avard for allowing them speak and Senator David Watters for his support.

BACKGROUND ON THIS ISSUE

PROPERTY TAX EXEMPTIONS

New Hampshire RSA 72:23 offers property tax exemptions for certain entities in New Hampshire including public schools & charitable organizations that own their own buildings/land.

THE ISSUE1. NH public charter schools do not receive building or construction aid to purchase their own facility.

2. New Hampshire state law RSA 194-b:5 prohibits public charter schools from incurring long-term debt until they have been in operation for more than five years. THE RESULT

Many public charter schools are forced to pay tens of thousands of dollars in property taxes that they should not.

HOW TO FIX

HB662 would modify RSA 72:23 granting New Hampshire public charter schools that lease facility space from an entity that is not tax exempt, a reimbursement for the amount they paid. |

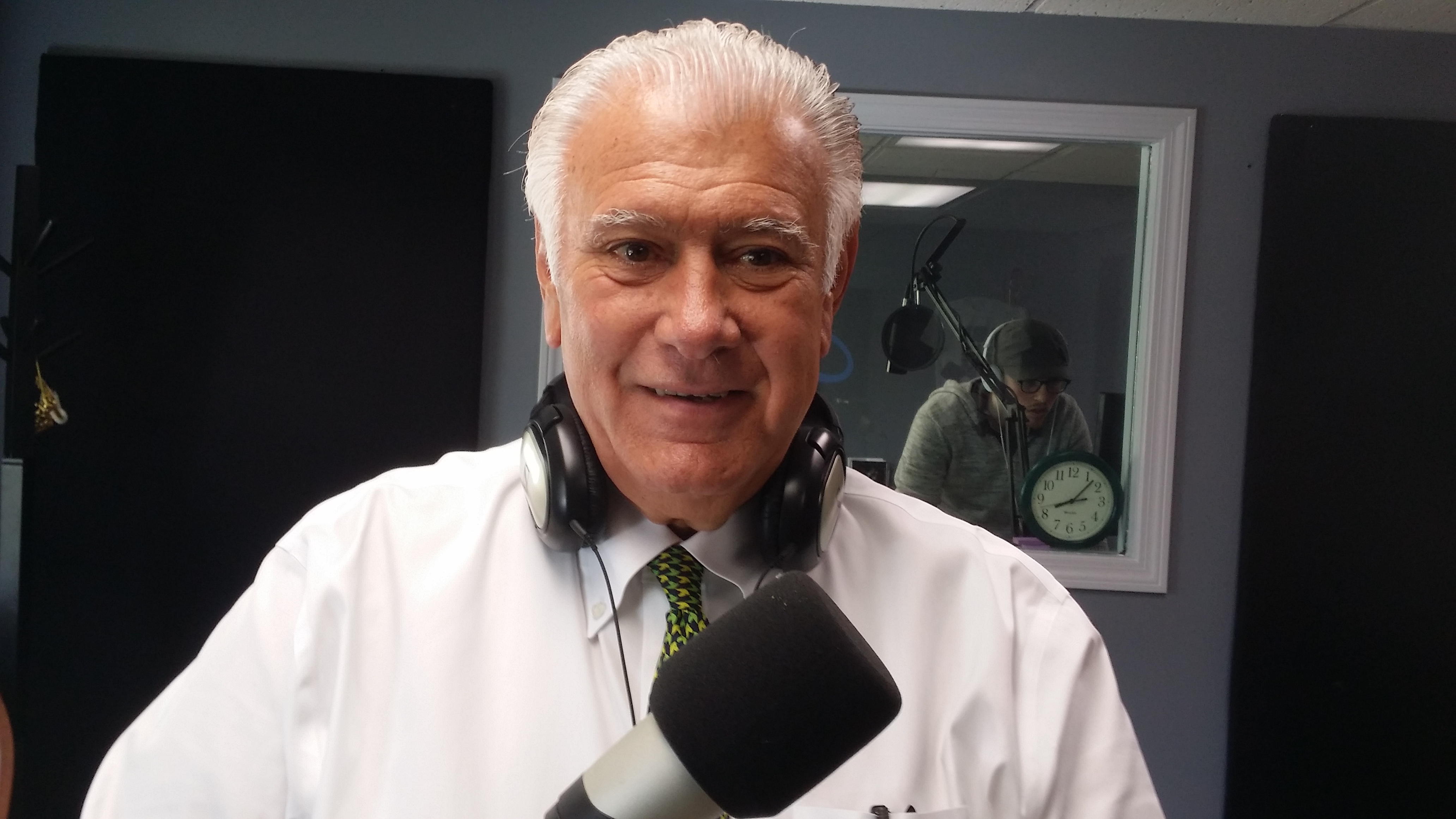

(Hour 2a) If a charter school rents property from a non tax exempt owner, should the property taxes made be refunded?

(Hour 2a) If a charter school rents property from a non tax exempt owner, should the property taxes made be refunded?![]() HB 662 is brought up and how it would allow for more savings to help fund teachers and students but it won’t be an easy one to pass. Hear the arguments against the bill and more and if you wish to read the press release from the lobbyist’s testimony, scroll below the sound cloud media player.

HB 662 is brought up and how it would allow for more savings to help fund teachers and students but it won’t be an easy one to pass. Hear the arguments against the bill and more and if you wish to read the press release from the lobbyist’s testimony, scroll below the sound cloud media player.