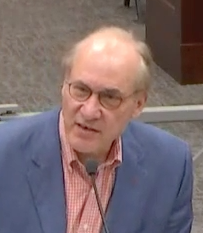

The following op-ed was written by Rep. Richard W.Barry (r-Merrimack), a Finance Committee Division Chairman. Publisher’s note: We publish this Op. Ed. even though we do not agree.

So why is it necessary for the New Hampshire legislature to raise the gas tax, or as it should correctly be called, the road toll fee? Quite simply, revenue received from this source has not kept up with the expense of maintaining the state’s roads and bridges.

Prior to last year’s fee increase, it had been 22 years since the legislature made any adjustment. In 1992 the price of gas was around 1 dollar per gallon, the federal fee was 18.4 cents per gallon, and the state fee was 18.2 cents per gallon for a total of 36.6 cents in tax per gallon. That left 64 cents for the producer, the distributor and the retailer and translated into an effective fee of around 56% on the price of a gallon of gas. Today the average price of gas has been hovering around $2.40 per gallon and has been unstable to say the least. In the last year it has been more than a dollar higher at times and more than fifty cents lower. The federal tax rate has remained the same while the state rate is 22.6 cents per gallon for a total tax of 41 cents per gallon. That is a tax rate of 17% on the price of gas, an effective decrease of over 300% in the tax rate versus the price of gas over the last 23 years. The economic reality is that the road toll fee has not supported the function and we are able do less each year with the money we collect.

Because the road toll fee is based on the volume of sales, the only way that the state can collect additional revenue is either through an increase in the volume of sales or for the legislature to periodically increase the rate to keep the tax proportional to the cost of the product, or to keep pace with the cost of the program(s) the fee supports. Periodic adjustments to the tax rate would be unnecessary when the sales volume increases at roughly the rate of inflation and meets the needs of a government, funded at a stable rate when compared to the overall economy.

We have seen the volume of gas purchased in New Hampshire decrease for a number of reasons. (1) today’s automobiles are more fuel efficient, with some models getting as much as 40 mpg; (2) the market for hybrid automobiles has increased resulting in less gas being purchased at the pumps; and (3) people are driving less. Without an increase in the fee, the amount of revenue that it provides actually goes down each year when we base it on the ability to purchase the other commodities necessary to fund the functions the fee is dedicated to support.

As the debate on the issue of raising the road toll fee (gas tax) continues, we all need to recognize the very important difference between a tax and a fee, which is based on a percentage of sale price of the commodity being taxed, and a tax or fee based on the sales volume. For example, let’s look at the rooms and meals tax. While in the past it has been increased specifically to raise additional revenue, in theory it never needs to be raised to keep pace with a reasonable level of government spending or to react to the reality of the economy. As the price of meals rises the state will collect more or less based simply on the cost of meals. We all recognize that those prices will steadily increase over time and the taxes collected will rise with it. When the price of a meal goes up by a dollar, the state gets more revenue, without taking action. In this case no one complains, or probably even notices.

In the past we were able to mask the symptoms in the Highway Fund through the use of federal stimulus money and by selling assets to the turnpike system, but all of those one time “solutions” have run their course and the hole they have left in the budget has been magnified by time.

Over the years the legislature should have continued doing what it had done since the inception of the road toll fee. We spent our money carefully and raised the fee only as it was absolutely necessary. If we had done that over the past 22 years, roads and bridges would have been repaired as needed and the actual cost of those repairs would have been less expensive. Repairing a bridge is not unlike roofing your home. If you replace the roof before it starts leaking then you don’t have to replace the roof deck or the ceilings in your home. It is the same with many bridge repairs, the longer we wait the more work there is to do.